How Credit Scores Work and What They Say About You

Credit scores help lenders decide whether or not to approve loan applications and determine what loan terms to offer. The score is generated by an algorithm using information from your credit reports, which summarize your borrowing history.

Credit Score Basics

Types of Scores

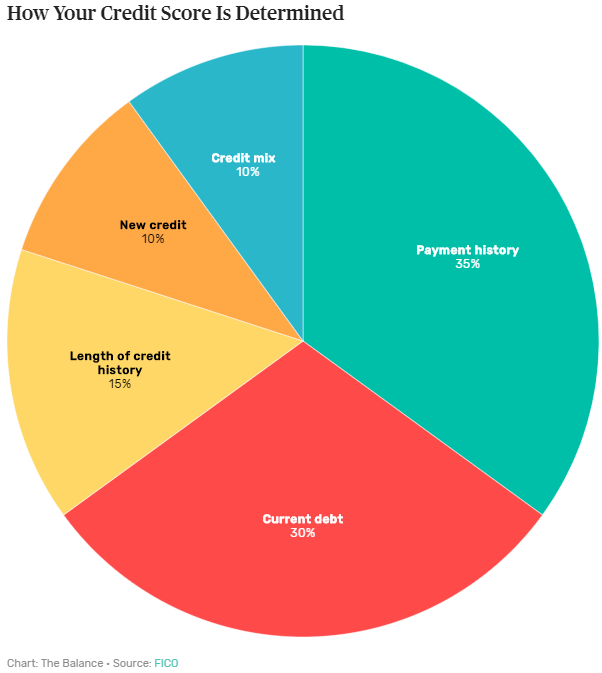

The FICO credit score looks at how much debt you have, how you’ve repaid in the past, and more. Scores range from 300 and 850 and are made up of the following components:

Payment history: 35 percent. Have you missed payments or defaulted on loans?

Current debt: 30 percent. How much do you owe, and are you maxed out?

Length of credit: 15 percent. Is credit new to you, or do you have a long history of borrowing and paying it back?

New credit: 10 percent. Have you applied for numerous loans in the recent past?

Types of credit: 10 percent. Do you have a healthy mix of different types of debt: auto, home, credit cards, and others?

Impact on Credit

Checking Your Credit

Getting Approval

Credit scores alone do not determine whether or not your loan request will be approved. They are simply numbers generated from your credit report and a tool for lenders to use. They set standards for which credit scores are acceptable and make the final decision.

To improve your credit scores, you have to show that you're a seasoned, responsible borrower who is likely to repay on time. If you build your credit files with positive information, your credit scores will follow. It takes time, but it is possible.

If you have any questions or comments, email me

at [email protected] and they will be included in the market update.

OR if you would like more information on our unique systems and programs, call us at 206-391-7766 or visit our website www.GeorgeMoorhead.com

©2019. All rights reserved